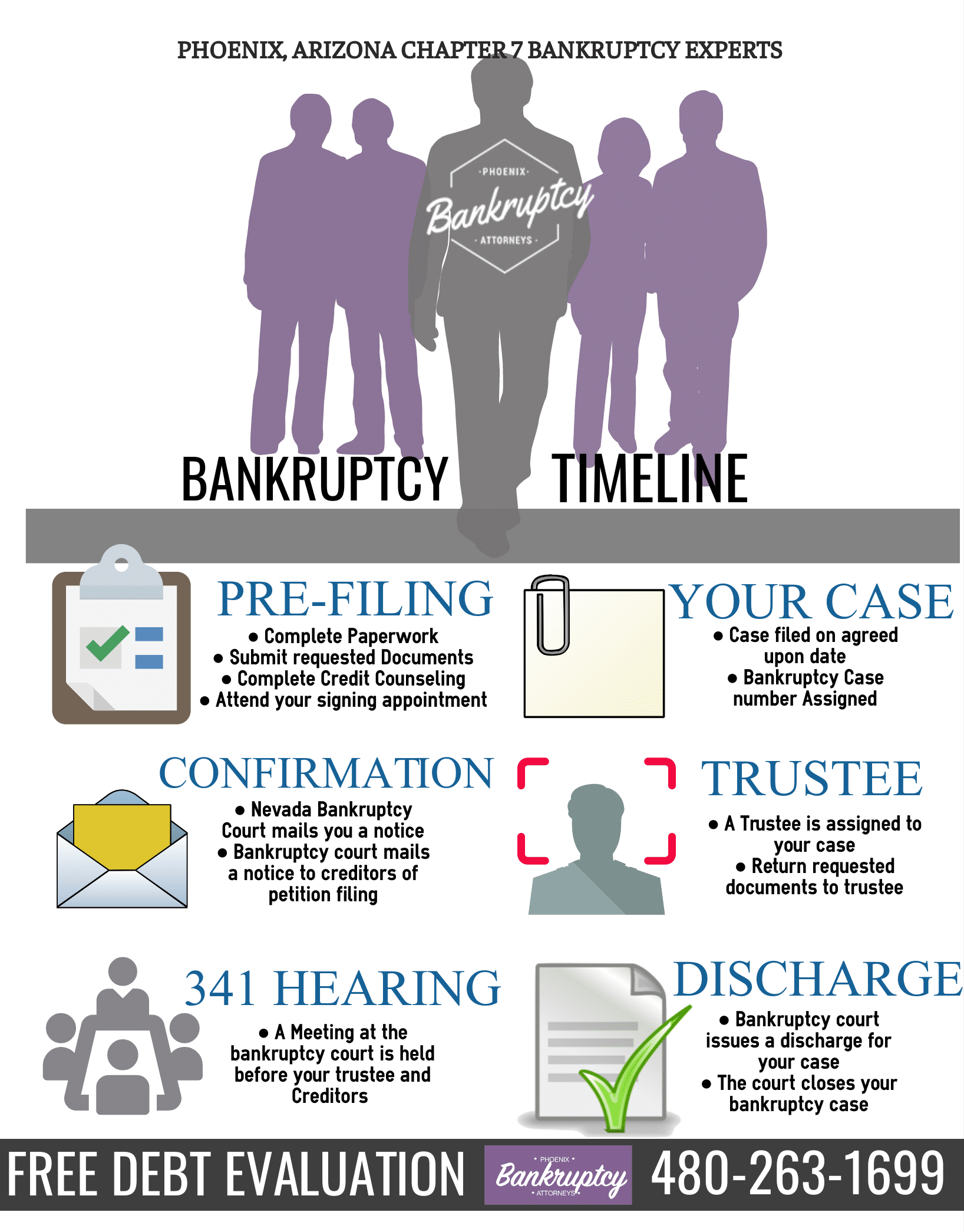

Chapter 7 Bankruptcy

What is a Chapter 7 bankruptcy?

A Chapter 7 bankruptcy is a liquidation of your unsecured debts. This means debts such as credit cards, medical bills, registration loans, evictions, and repossessions will be discharged. Some debts, such as back taxes, title loans, student loans, and domestic obligations, aren’t dischargeable. You also have the opportunity to surrender any vehicles you have financed if you can’t keep up with the payments or you owe far more than the vehicle’s value.

Is it hard to qualify for a Chapter 7? What are the qualifications?

There are two ways to qualify for a Chapter 7 bankruptcy. The first is by making less than the median income level for your family size. Your family size will include your spouse and minor children. In Arizona, the median income level for a family of one is $51,388 and goes up from there.

If your income is higher than your state’s median income level, you can still qualify for a Chapter 7 bankruptcy through the means test. The means test will take paycheck deductions and reasonable expenses out of your income to determine if you have disposable income left at the end of the month to pay your debts. Keep in mind that expenses deemed “reasonable” by the bankruptcy court may be far lower than how much you actually spend.

If I am current on my mortgage, can I keep my home in a Chapter 7?

This depends on how much equity you have in your home. In Arizona, the homestead exemption is $150,000. As long as you don’t have more than that much equity in your home, you can continue making your mortgage payments and keep your home.

If you are behind on your mortgage, you may want to consider a Chapter 13 bankruptcy. This will allow you to spread the past-due amount, along with other debts, over a 3-5 year repayment plan.

What happens to my credit in a Chapter 7 bankruptcy?

If you have good credit to begin with, you will likely see a slight initial drop in your credit score after you file. If your credit was poor, it will either stay the same or you may see a slight increase. You will receive a credit report with a projected credit score one year from filing when we draft your petition.

There are steps you can take post-bankruptcy to rebuild your credit. If you finance a vehicle after you file, the positive payments will be reported. If you keep the same vehicle through your bankruptcy, the lender won’t be required to report positive payments. You can also open a secured credit card through your bank, or a traditional credit card if you get approved. Our office offers $0 down post-filing payment plans that credit report as well.

Do I file Chapter 7 or Chapter 13? How do I know?

If you make above the median income level for your family size and are unable to pass a means test as described above, you may still be able to file a Chapter 13. A Chapter 13 is also ideal for those wanting to retain vehicles, houses, or other assets that they are behind on. You can also file Chapter 13 if you have filed bankruptcy too recently to file a Chapter 7, or if your assets are above the exemption limits for your state.

I filed Chapter 7 but I am in debt again, can I file again?

Once you file a Chapter 7 bankruptcy, it is eight years before you can file again. If it hasn’t been eight years yet, you may still be able to file a Chapter 13 bankruptcy. Since a Chapter 13 lasts 3-5 years, your eight year period may finish during your Chapter 13. If so, it may be converted back into a 7 if the eight year period ends during your 13.

How much does filing bankruptcy cost?

The court filing fees for a Chapter 7 bankruptcy are $335. For a Chapter 13, the filing fee is $310. For both chapters, you will be required to take online credit counseling courses that will cost around $30. Attorney’s fees will depend on the chapter you file, the complexity of your case, and the type of payment arrangement you set up with your attorney.

Filing Chapter 7 Bankruptcy

Helping Phoenix Debtors Eliminate Debt Through Chapter 7 Bankruptcy

Are you getting harassed by creditors over the phone and mail? If it seems like your financial future is hopeless, there is a solution to your problems! Affordable Phoenix Bankruptcy Lawyers offers free consultations and debt evaluations. Find out if a chapter 7 bankruptcy is right for your debt relief. Chapter 7 bankruptcy is the fastest and easiest type of bankruptcy to pursue. This experienced chapter 7 bankruptcy attorney in Phoenix can help you achieve financial stability. Call our Phoenix debt relief team for low cost debt relief in Phoenix.

Reasons vary for being under financial strain and many Phoenix residents struggle to make ends meet. As a result, bankruptcy is often a legitimate way to reboot your financial future and eliminate crushing debt. Creditors’ Lawsuits, car repossessions, wage garnishments, and constant collection attempts are just a few problems hunting individuals, families, and businesses in Phoenix and surrounding communities.

In addition, many homeowners are in foreclosure after experiencing a job loss, decrease in pay, and/or an increase in their monthly mortgage payments. No matter what type of financial problems you are facing, a Chapter 7 Bankruptcy expert will work to give you the “Fresh Start” that you deserve. By all means, call (480) 263-1699 for a free consultation (Either in one of our Phoenix area offices or by phone, Your Choice!)

Experienced Chapter 7 Bankruptcy Lawyers in Phoenix, Arizona

OUR CHAPTER 7 BANKRUPTCY LAWYERS CAN HELP YOU

Having debt causes anxiety. Phoenix Bankruptcy Attorneys are here to help you become stress free. It does not matter if you are facing a foreclosure, a repossession, or have incurred insurmountable credit card debt, give Phoenix Bankruptcy Attorneys a call at (480) 263-1699.

AREAS OF PRACTICE AND EXPERTISE

Take a Look at How Our Firm Can Help You

Bankruptcy Lawyers in Phoenix, Arizona

Being in debt causes anxiety. Phoenix Bankruptcy Attorneys are to help ease the anxiety. It does not matter if you are facing a foreclosure, a repossession, or have incurred insurmountable credit card debt, give Phoenix Bankruptcy Attorneys a call at (480) 263-1699.

Are you struggling to make ends meet? Do creditors harass you over the phone and through the mail? Does your financial future seem hopeless? If so, there is a solution to your problems! A Phoenix Bankruptcy Lawyer offers free consultations and debt evaluations. Find out what types of debt relief are available and which form of debt relief may be the most beneficial for your particular situation. This affordable bankruptcy attorney in Phoenix can help you achieve the financial freedom you seek. Become debt free!

In today’s difficult times, many people are finding it very difficult to keep up with their financial obligations. In fact, more and more people throughout Arizona are losing their jobs or getting their hours and paychecks reduced, resulting in an unexpected loss of income. Creditors’ Lawsuits, car repossessions, wage garnishments, and constant collection attempts are just a few problems plaguing individuals, families, and businesses in Phoenix and surrounding communities. Additionally, many homeowners are in foreclosure after experiencing a job loss, decrease in pay, and/or an increase in their monthly mortgage payments. No matter what type of financial problems you are facing, a debt relief expert can help you figure out the best solution to your problem and will work to give you the “Fresh Start” that you deserve. Call (480) 263-1699 for a free consultation (Either in one of our Phoenix area offices or by phone, Your Choice!)

Free Consultation with a Bankruptcy Lawyer in Phoenix

We also offer free bankruptcy consultations in one of our Phoenix area offices and initial evaluations by telephone with one of our experienced attorneys. By all means, call us today and set up your free consultation. For example, maybe you are facing a foreclosure, a repossession, or have incurred insurmountable credit card debt. Our attorneys can go over these issues with you locally here in Phoenix and let you know whether bankruptcy is a good option for you. Remember, bankruptcy is only one option, and an experienced bankruptcy lawyer can develop comprehensive and creative solutions to your debt problems. Furthermore, bankruptcy is our business, let our years of experience and know-how work for you to get you the debt relief that you are seeking.

Our 3-Step process

PHOENIX BANKRUPTCY ATTORNEYS CAN HELP YOU GET OUT OF DEBT

File Now … Pay Later!

Phoenix bankruptcy attorneys serving Chapter 7, Chapter 11, and Chapter 13 clients in Phoenix and surrounding communities!