Filing Chapter 13 Bankruptcy

Helping Phoenix Debtors Eliminate Debt Through Chapter 13 Bankruptcy

Free Consultation with a Chapter 13 Bankruptcy Lawyer

Being in debt causes anxiety. Filing for Chapter 13 Bankruptcy is a debt relief solution. It does not matter if you are facing a foreclosure, a repossession, or have incurred insurmountable credit card debt, give our Bankruptcy Lawyers a call at (480) 263-1699.

We offer free bankruptcy consultations and initial evaluations by telephone with one of our experienced chapter 13 bankruptcy attorneys. By all means, call us today and set up your free consultation. For example, maybe you are facing a foreclosure, a repossession, or have incurred insurmountable credit card debt. Our attorneys can go over these issues with you and let you know whether filing a chapter 13 bankruptcy is a good option for you. Remember, bankruptcy has many chapters you can file under. An experienced bankruptcy lawyer can develop comprehensive and creative solutions to your debt problems. Furthermore, bankruptcy is our business, let our years of experience and know how work for you to get you the debt relief that you are seeking.

How Chapter 13 Bankruptcy in Phoenix Can Help

Phoenix Chapter 13 Bankruptcy Attorneys

Filing a Chapter 13 Bankruptcy in Phoenix can assist you in reducing or eliminating your debt, including: medical debt, utility payments, unsecured debt, credit card debt, and various types of loans. Once you file for Chapter 13 protection in Phoenix, Arizona, an automatic stay will be go into place and your creditors must stop all collection processes against you.

Many people in Phoenix and throughout Maricopa County are in need of Chapter 13 Bankruptcy. Filing is especially beneficial to a person who is behind on their mortgage payment or has other secured debt. You can save your home and property with a chapter 13 bankruptcy as it 13 allows you to pay the arrears or back debt through the Chapter 13 payment plan.

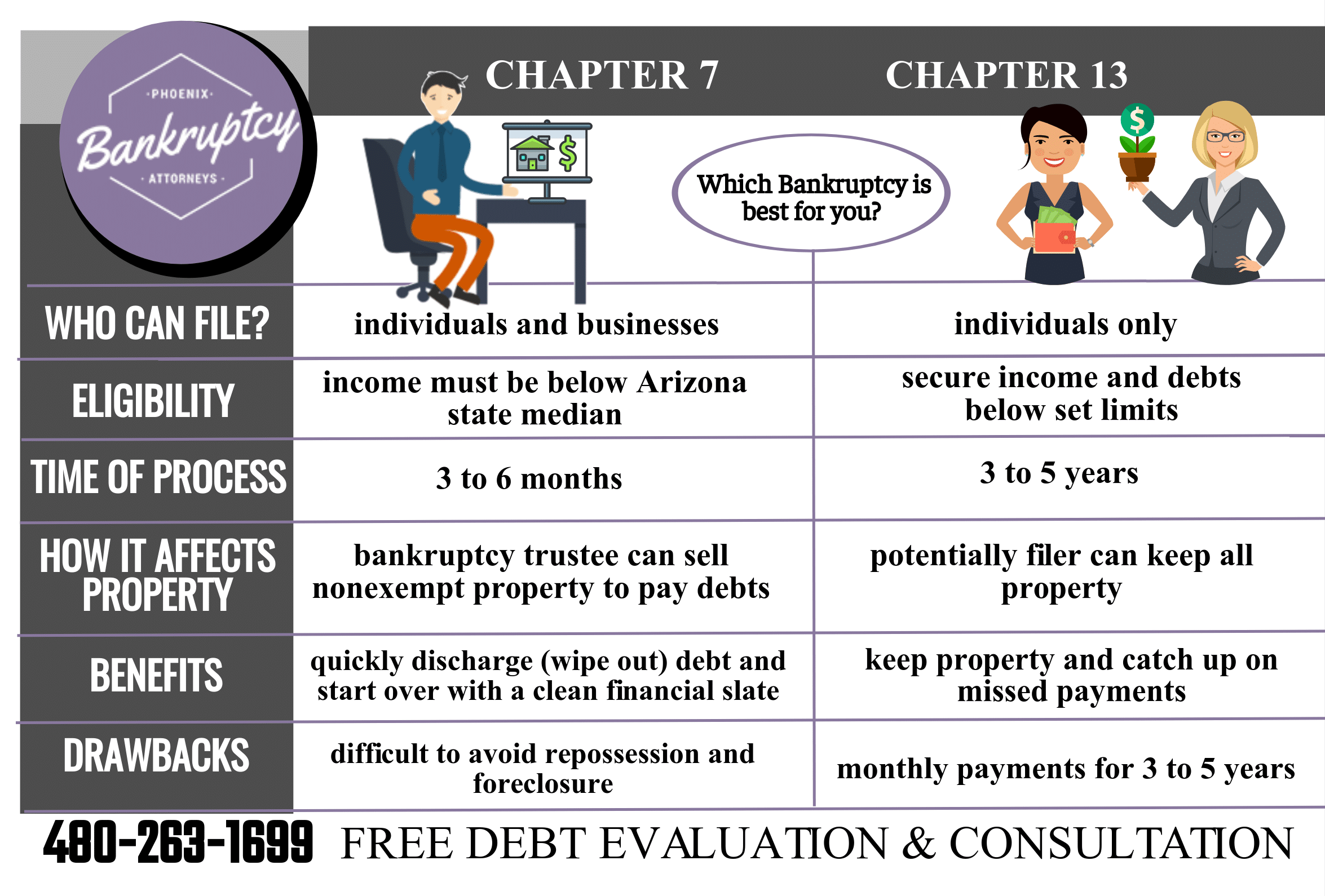

Chapter 13 Payment Plans Are 3 to 5 Years

The Chapter 13 payment plan is usually 3 or 5 years. A Phoenix Chapter 13 bankruptcy essentially consolidates the debt into a manageable monthly payment plan. Your monthly payment will be determined by the Chapter 13 bankruptcy trustee and is based on your disposable income and what you can afford. The plan takes into account your cost of living and then determines your payment plan based on the leftover income.

In order to qualify for a Chapter 13 bankruptcy, a person must have a regular income as the debtor is required to make monthly payments. Declaring Chapter 13 bankruptcy is only available to individuals that have a regular income because the debtor is required to make monthly payments in a chapter 13 payment plan. Consult an experienced Phoenix Chapter 13 attorney to find out if you meet the requirements.

Chapter 13 Bankruptcy Lawyer in Phoenix

Phoenix Chapter 13 Bankruptcy Attorney

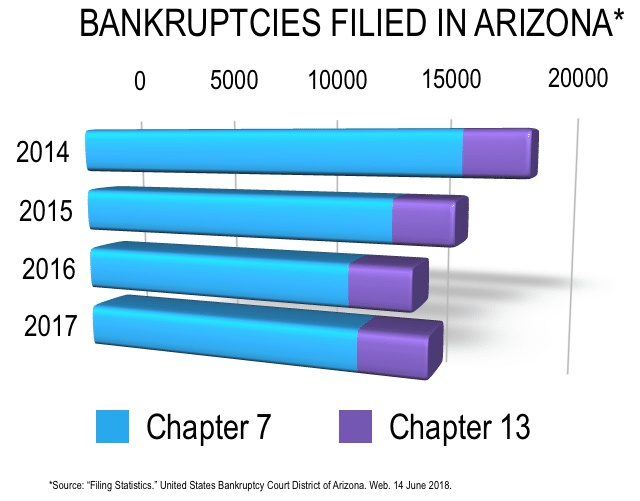

The 2nd most popular chapter of bankruptcy filed in Phoenix, Arizona is Chapter 13 bankruptcy. Thus, ch 13 bankruptcy is something that may work better for people who have regular income as a person filing chapter 13 pays back a portion of their debt through a repayment plan. The most popular chapter of bankruptcy in Phoenix is chapter 7 which doesn’t require a payment plan.

Additionally, filing a bankruptcy Ch 13 in Phoenix immediately “stays” or stops any creditor action. Creditor actions include: judgements, garnishments, repossessions, foreclosure, seizure, and all creditor attempts at collection. The collection tactics that must stop once a chapter 13 bankruptcy is filed include: service of law suits, phone calls, demands, and letters. The “Automatic Stay” of a ch 13 bankruptcy protects from any further collection actions by creditors.

Also, in a chapter 13 bankruptcy, a person files a plan with the federal bankruptcy court and agrees to pay all debts such as car loans, mortgage arrears, and unseen debts in an affordable monthly payment plan over a three to five-year period. Our Arizona chapter 13 bankruptcy lawyer works with you and stays on your ch 13 case from start to finish. Typical repayment plans are 3 to 5 years, Therefore, to get an exact amount of what your Ch 13 payment may be also to focus in on the exact amount of payments you will be making, contact our Phoenix Chapter 13 attorneys today.

Can a Chapter 13 Bankruptcy Stop a Foreclosure?

Living in Phoenix and received a foreclosure notice? If so, do not panic! There is debt relief assistance to combat your foreclosure notice. A foreclosure notice does not mean the lender or bank can take your house tomorrow. There is a period of time for you to react and save your home.

Most people in Phoenix will do whatever it takes to save their home. Depending on how far behind a homeowner falls in mortgage payments, foreclosure can be a scary process. Negotiating with the bank only works if you have money to restructure payments or modify your loan completely. However, if working out a plan like this is not an option, eventually the lender will move your account to a foreclosure status and proceed with the repossession of your home through a legal sale. Understanding your options during the foreclosure process requires the help of a skilled attorney. Declaring bankruptcy in Phoenix provides legal protection that can be leveraged in such situations.

Chapter 13 Payment Plan

Our Ch 13 Lawyer Can Figure Your Plan Payment

Payments in Phoenix chapter 13 plans can be as low as $100 a month. Payments are based on your disposable income. Therefore, determining payment amount factors on the filer’s debt, income, assets, and situation. Keep in mind, each chapter 13 bankruptcy case is unique, however, our Phoenix bankruptcy attorney can figure and give you an approximate chapter 13 plan payments once we have done a free debt evaluation with you.

There are many myths regarding chapter 13 bankruptcy filings. Consulting an experienced phoenix chapter 13 lawyer is the best way to get the correct answers. In a chapter 13 bankruptcy, you are able to keep the property (home, vehicle and other assets) in exchange for paying the monthly payment plan in a chapter 13 bankruptcy.

Additional Chapter 13 Bankruptcy Benefits

There are many additional benefits in a Phoenix chapter 13 bankruptcy. Some of the ch 13 benefits which allows you to: pay off back taxes, save your home from foreclosure, and reduce high interest car loans. Additionally, for many people in the Phoenix and Mesa, Arizona, the benefits of chapter 13 bankruptcy are exceptional. To learn more about the benefits of a Nevada chapter 13 bankruptcy, contact our Phoenix bankruptcy attorney office today

Neighborhood Areas in Phoenix That We serve:

-

Downtown phoenix

-

Ahwatukee

-

Central Phoenix

-

South Phoenix

-

North Phoenix

-

Desert Ridge

-

Camelback East

-

Deer Valley

-

Biltmore

-

North Mountain

-

South Mountain

-

Norterra

-

Maryvale Village

-

Estrella Village

-

Encanto Village

-

Paradise Valley Village

And the surrounding areas of the Phoenix Metro

Zip Code Areas in Phoenix That We serve:

- 85001

- 85002

- 85003

- 85004

- 85005

- 85006

- 85007

- 85008

- 85009

- 85010

- 85011

- 85012

- 85013

- 85014

- 85015

- 85016

- 85017

- 85018

-

85019

- 85020

-

85021

- 85022

- 85023

- 85024

- 85025

- 85026

- 85027

- 85028

- 85029

- 85030

- 85031

- 85032

- 85033

- 85034

- 85035

- 85036

- 85037

- 85038

- 85039

- 85040

- 85041

- 85042

- 85043

- 85044

- 85045

- 85046

- 85048

-

85050

- 85051

- 85053

- 85054

- 85055

- 85060

- 85061

- 85062

- 85063

- 85064

- 85065

- 85066

- 85067

- 85068

- 85069

- 85070

- 85071

- 85072

- 85073

- 85074

- 85075

- 85076

- 85077

- 85078

- 85079

- 85080

- 85082

- 85085

- 85086

- 85087

- 85098

- 85099

AREAS OF PRACTICE AND EXPERTISE

Take a Look at How Our Phoenix BK Firm Can Help You

Ch 13 Bankruptcy Lawyers in Phoenix, Arizona

Being in debt causes anxiety. Phoenix Bankruptcy Attorneys are to help ease the anxiety. It does not matter if you are facing a foreclosure, a repossession, or have incurred insurmountable credit card debt, give Phoenix Bankruptcy Attorneys a call at (480) 263-1699.

Are you struggling to make ends meet? Do creditors harass you over the phone and through the mail? Does your financial future seem hopeless? If so, there is a solution to your problems! Phoenix Bankruptcy Lawyers offer free consultations and debt evaluations. Find out what types of debt relief are available and which form of debt relief may be the most beneficial for your particular situation. This affordable bankruptcy attorney in Phoenix can help you achieve the financial freedom you seek. Become debt free!

We are Here in These Difficult Times

In today’s difficult times, many people are finding it very difficult to keep up with their financial obligations. In fact, more and more people in Phoenix, Maricopa County, Arizona are losing their jobs or getting their hours and paychecks reduced, resulting in an unexpected loss of income. Creditors’ Lawsuits, car repossessions, wage garnishments, and constant collection attempts are just a few problems plaguing individuals, families, and businesses in Phoenix and surrounding communities.

In addition, many homeowners are in foreclosure after experiencing a job loss, decrease in pay, and/or an increase in their monthly mortgage payments. No matter what type of financial problems you are facing, a debt relief expert can help you figure out the best solution to your problem and will work to give you the “Fresh Start” that you deserve. Call (480) 263-1699 for a free consultation (Either in one of our Phoenix area offices or by phone, Your Choice!)

Free Consultation with a Bankruptcy Lawyer in Phoenix

We also offer free bankruptcy consultations in one of our Phoenix area offices and initial evaluations by telephone with one of our experienced attorneys. By all means, call us today and set up your free consultation. For example, maybe you are facing a foreclosure, a repossession, or have incurred insurmountable credit card debt. Our attorneys can go over these issues with you locally here in Phoenix and let you know whether bankruptcy is a good option for you. Remember, bankruptcy is only one option, and an experienced bankruptcy lawyer can develop comprehensive and creative solutions to your debt problems. Furthermore, bankruptcy is our business, let our years of experience and know-how work for you to get you the debt relief that you are seeking.

Our 3-Step process

PHOENIX BANKRUPTCY ATTORNEYS CAN HELP YOU GET OUT OF DEBT

File Now … Pay Later!

Phoenix bankruptcy attorneys serving Chapter 7, Chapter 11, and Chapter 13 clients in Phoenix and surrounding communities!