LIFE AFTER BANKRUPTCY IN ARIZONA

IS THERE LIFE AFTER BANKRUPTCY?

Life after bankruptcy? Of course life goes on after bankruptcy. Although a serious matter, declaring bankruptcy is sometimes a necessity in order to provide a fresh start to someone experiencing crushing debt. For those individuals who need to eliminate debt through bankruptcy protection, life before bankruptcy was stressful, draining, and seriously harming their credit.

LIVING WITH DEBT IN PHOENIX

Many Phoenix, Arizona residents find themselves in an all too familiar situation: a pile of bills on the kitchen table. Debts accumulated over the last few years that there is not a chance will ever be fully paid off. A loss of job, causing all savings to be depleted and credit cards to be maxed out. A medical emergency that has accumulated outstanding bills. Even minimum monthly payments on bills cannot be made on time or at all. Rent is due, car payment is due, loan payments are due, despite getting a new job and having an income. At some point these kinds of debt issues drive a person to consider bankruptcy or debt relief options.

If you are considering bankruptcy, it is important to understand the entire process, from beginning to end, and then after the bankruptcy discharge. Just remember, there is life after bankruptcy.

REBUILD YOUR LIFE AFTER FILING BK

REBUILD YOUR FINANCIAL FUTURE

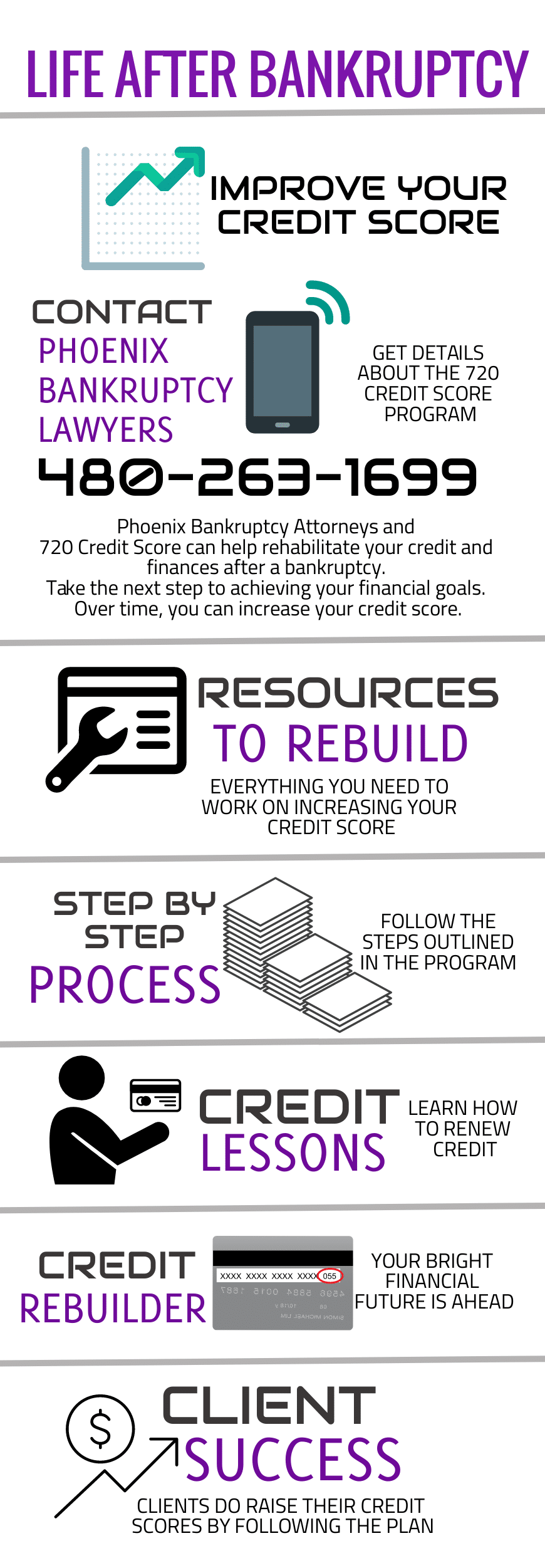

Now that you have taken control of your debt, you need to take control of your life after bankruptcy. Your bankruptcy discharge gave you an opportunity to find a new financial beginning. Our Phoenix Bankruptcy Service can provide you with the tools you need to successfully rebuild your credit and begin to repair your financial future.

In addition, our law firm offers a program, that if followed, has helped our clients establish good credit and learn how to manage finances in their new start-over. First, maintaining a job/income will help regain your confidence and your finances. A stable employment history shows reliability, and wages pay the bills. Also, pay all bills on time. Stay current on monthly payments after bankruptcy so your record stays clean. Plus, maintain a checking or savings account and keep a positive balance in any account at all times, showing a reliable cash flow.

Furthermore, our life after bankruptcy program shows you how to rebuild credit by obtaining a credit card and learn how to use it wisely. Despite your flawed credit history, you can show that you have control over the credit. Knowing if you are slipping back into debt and seeking help immediately is very important.

OUR FIRM IS WITH YOU THROUGHOUT THE ENTIRE BANKRUPTCY PROCESS – EVEN AFTER THE DISCHARGE

Our Phoenix Bankruptcy Attorney law firm will help you if you seek to eliminate debt through bankruptcy, and our team will support you as you begin your new life without debt. We can also offer assistance to repair credit and rebuild your financial future. Our Phoenix debt relief team will help you navigate life after bankruptcy.

LIFE AFTER BANKRUPTCY

What is life like after bankruptcy?

Your life should be very similar after bankruptcy, but hopefully with a bit less stress. Once your bankruptcy is filed, any wage garnishments and other debt collections will be stopped. Your creditors aren’t allowed to contact you once you inform them you have retained a bankruptcy attorney, but they will be notified once your case is filed by the court. Your work will only be notified of your bankruptcy if you have a garnishment, and your landlord will only be notified if you intend to break the lease.

Am I really debt free after filing Chapter 7?

It depends what types of debts you have. Debts such as medical bills, credit cards, registration loans, repossessions, and evictions will be discharged. Some back debts to the IRS may be discharged if they meet certain requirements. Other back taxes and domestic obligations, however, won’t be discharged in the bankruptcy. This is also true for student loans. You will be protected from garnishment by the automatic stay once your case is filed, but collection will resume once your case is discharged.

It depends what types of debts you have. Debts such as medical bills, credit cards, registration loans, repossessions, and evictions will be discharged. Some back debts to the IRS may be discharged if they meet certain requirements. Other back taxes and domestic obligations, however, won’t be discharged in the bankruptcy. This is also true for student loans. You will be protected from garnishment by the automatic stay once your case is filed, but collection will resume once your case is discharged.

Filing Chapter 7 bankruptcy in Phoenix is also your chance to surrender a vehicle with an upside-down balance. You can keep paying on your car and keep the vehicle if you meet your state’s exemption limits, but a judge may not formally reaffirm the payment plan if it seems like a bad investment.

Suggestions not to land back in financial peril?

In the periods immediately before, during, and after your bankruptcy, you should limit your purchases to reasonable necessities. You should avoid taking out any high-interest lines of credit because you won’t be able to file another Chapter 7 bankruptcy for eight years.

If you are struggling to make payments on an expensive home or vehicle, surrendering them in the bankruptcy is a good way to ensure you don’t land back on the same path. Even if you love your car or are afraid you won’t be able to get a new vehicle once you file, keeping your vehicle can be a risky option. Carefully consider your budget, balance vs. car value, and anticipated repairs in mind when deciding whether to keep or surrender your vehicle.

You will be required to take two online credit counseling courses in order to complete your bankruptcy. One is before you file, and the second must be taken within 60 days of your 341 Meeting of Creditors. Both will include a chat with a credit counselor. If you are considered with avoiding falling back into your current financial situation, listen to your counselor. They will provide you with advice based on information you provide them.

How will I ever get credit again if I file bankruptcy?

If you are considering filing bankruptcy, you will probably have a harder time opening up a new line of credit now than after you file. Many lenders will be more willing to loan you money once your other debts have been cleared since your disposable income isn’t going towards paying your debt anymore. If you can’t get a new credit card after your bankruptcy, you can get a secured (pre-paid) credit card through your bank to help re-build your credit. Financing a new vehicle will also help your credit score rise. Our firm offers a $0 down payment plan option for Chapter 7 bankruptcies so you can pay for your bankruptcy after you file, and the payments are credit reported.

Will I ever be able to buy a home? A car? Can I get a credit card?

You will be eligible for FHA loans 2 years after your bankruptcy. You will still be able to rent a house or apartment. Our office can send a letter to any potential landlords concerned about renting to you because of the bankruptcy.

Many of our clients are able to get a new vehicle the day after they file. Auto loan lenders may be more willing to work with you once you have wiped away all of your other debts. If you keep paying on your old vehicle through your bankruptcy, the lender is no longer required to credit report positive payments. This means paying on your current vehicle won’t help your credit score after your bankruptcy. One of the benefits of getting a new vehicle after you file is that those payments will be credit reported.

You will likely receive offers in the mail for new credit cards after your bankruptcy. However, your credit before the bankruptcy and the steps you take after the bankruptcy can affect your approval on these cards. If you are unable to get approved, you can open a secured credit card with your bank.

Our 3-Step process

PHOENIX BANKRUPTCY ATTORNEYS CAN HELP YOU GET OUT OF DEBT

File Now … Pay Later!

Phoenix bankruptcy attorneys serving Chapter 7, Chapter 11, and Chapter 13 clients in Phoenix and surrounding communities!

DISCLAIMER: The information you obtain at this Arizona Bankruptcy Law web site is not, nor is it intended to be, legal advice. Therefore, you should consult a Phoenix bankruptcy lawyer for advice regarding your individual situation. Additionally, our Arizona Bankruptcy lawyers and staff invite you to contact our Arizona Bankruptcy Law Firm and welcome your calls, letters, and electronic mail. Plus, contacting us does not create an attorney-client relationship. Please do not send any confidential information to us until such time as an attorney-client relationship has been established. Thank you for visiting our Phoenix debt relief web site.

Our Phoenix bankruptcy attorneys can assist you with Life After Bankruptcy and are located in Phoenix, Arizona, and serve bankruptcy clients in Scottsdale, Phoenix, Glendale, Gilbert, Queen Creek, Tempe, Mesa, Chandler, Pleasant Valley, Avondale, Cashion, Casa Grande, Surprise, Prescott, Marana, Tucson, El Mirage, Peoria, Sun City, Sun City West, Tolleson, Youngtown, Flagstaff, and Pima, Pinal, and Maricopa County.

Contact Us

File Now … Pay Later!

Phoenix bankruptcy attorneys serving Chapter 7 and Chapter 13 clients in Phoenix and surrounding communities!