FAQs

Frequently Asked Bankruptcy Questions

Question: Can I get medical care if I file for bankruptcy?

FAQ Answer: There is no guarantee that if you file bankruptcy on your doctor, you won’t get dropped by the medical provider. If you and your attorney have determined the best course of action for your financial and debt-relief needs is bankruptcy, you have no choice but to list medical debt on the petition. Clients faced with this dilemma discussed the situation with their doctor. Many times, the doctor’s office will arrange a payment plan so that even if the debt gets discharged in a bankruptcy, the bill can be paid.

Chapter 7 cases: A Chapter 7 bankruptcy eliminates unsecured debt, and medical bills are unsecured debt. Any and all unsecured debt and creditors must be documented on the bankruptcy papers.

Question: How long will it take before I get a discharge of my Phoenix bankruptcy case?

FAQ Answer: Keep in mind, there is no guarantee of a discharge when you file your bankruptcy case in Phoenix. However, here are the average time for bankruptcy discharges in Phoenix:

Chapter 7 bankruptcy cases: The average discharge time is 5 to 6 months after filing.

Chapter 13 bankruptcy cases: Are set up by the bankruptcy court trustee to run for 36 to 60 months; once all payments are made and provisions of the Chapter 13 plan have been fulfilled, the chapter 13 bankruptcy will be discharged.

Chapter 11 and Chapter 12 bankruptcy cases: Chapter 11 and 12 bankruptcies are on a case by case basis. Usually they are structured by the bankruptcy trustee to be shorter than Chapter 13 case, however, it will depend on the individual circumstances of the case.

Question: Do I have to go to court in order to file for bankruptcy?

FAQ Answer: Yes, the Arizona bankruptcy law requires that you attend a Section 341 (Meeting of Creditors). A 341 Hearing in Phoenix, Arizona is conducted by the bankruptcy trustee assigned to your case. If filing a bankruptcy in Maricopa County, your 341 hearing will be held at:

Phoenix Division U.S. Courthouse and Federal Building

Address:

230 N. First Ave, Suite 101

Phoenix, AZ 85003

Phone:

General:

602-682-4000 or 800-556-9230

Click for more information about Phoenix Bankruptcy Court.

At your Phoenix 341 Hearing, the Arizona bankruptcy trustee will ask you questions about your petition, assets, and liabilities. In most cases, this court appearance is the only one required, and you will not even see the judge assigned to your case. In addition, your Phoenix bankruptcy lawyer, will attend your 341 Hearing with you to protect your interests. Our Phoenix bankruptcy lawyers will be there for you every step of the way throughout your bankruptcy filing.

Question: If my paycheck is garnished, Can I get any of that money back?

FAQ Answer:

Address:

230 N. First Ave, Suite 101

Phoenix, AZ 85003

Phone:

General:

602-682-4000 or 800-556-9230

Click for more information about Phoenix Bankruptcy Court.

At your Phoenix 341 Hearing, the Arizona bankruptcy trustee will ask you questions about your petition, assets, and liabilities. In most cases, this court appearance is the only one required, and you will not even see the judge assigned to your case. In addition, your Phoenix bankruptcy lawyer, will attend your 341 Hearing with you to protect your interests. Our Phoenix bankruptcy lawyers will be there for you every step of the way throughout your bankruptcy filing.

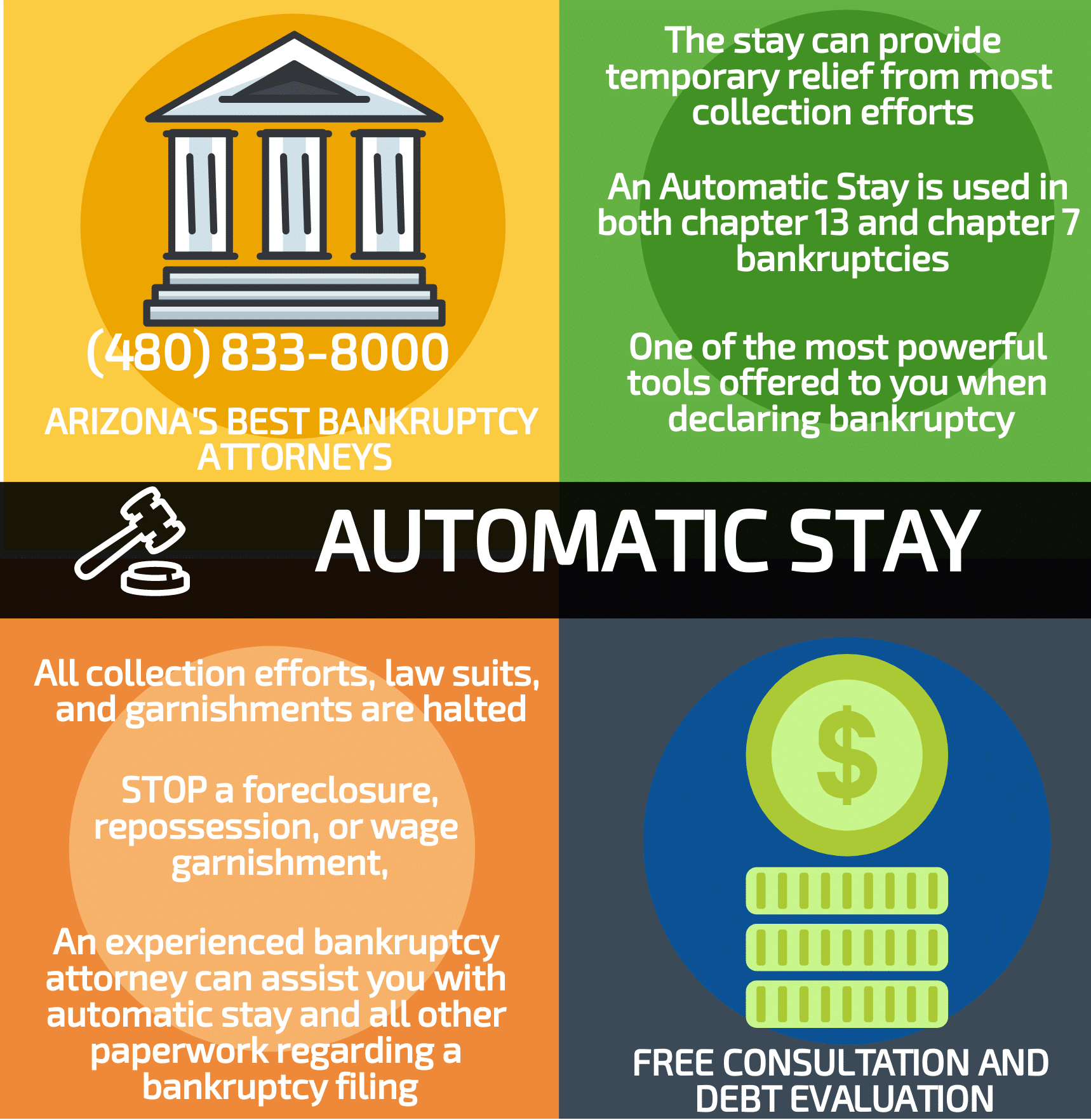

Question: What is the Automatic Stay in Bankruptcy and How Does it Work?

FAQ Answer:

What exactly is The Automatic Stay? The Automatic Stay is just that, a stay. While a stay is not permanent the stay can provide temporary relief from most collection efforts. The stay goes into effect the moment that a bankruptcy case is filed. The automatic stay remains in place until the bankruptcy is either discharged, dismissed, or the creditor files and is successfully granted a motion to lift the stay. The stay is awarded in both Chapter 7 and Chapter 13 bankruptcy filings.

What exactly is The Automatic Stay? The Automatic Stay is just that, a stay. While a stay is not permanent the stay can provide temporary relief from most collection efforts. The stay goes into effect the moment that a bankruptcy case is filed. The automatic stay remains in place until the bankruptcy is either discharged, dismissed, or the creditor files and is successfully granted a motion to lift the stay. The stay is awarded in both Chapter 7 and Chapter 13 bankruptcy filings.The Automatic Stay will stop most actions, but not all. Certain things like child support, criminal restitution, divorce proceedings, taxes, and some evictions cannot be stalled by the Automatic Stay. It is important to speak with a lawyer to determine if the Automatic Stay will help your particular situation.

If you are behind on your car payments or mortgage payments and file a Chapter 7 bankruptcy, the creditor will usually petition the court to remove the stay so that they may proceed with a garnishment or foreclosure. You will typically have a 20 day period to respond. If you are wanting to keep the property you are behind on than a Chapter 13 may be a better option and your attorney can advise you as to which chapter would best benefit you.

Address:

230 N. First Ave, Suite 101

Phoenix, AZ 85003

Phone:

General:

602-682-4000 or 800-556-9230

Click for more information about Phoenix Bankruptcy Court.

At your Phoenix 341 Hearing, the Arizona bankruptcy trustee will ask you questions about your petition, assets, and liabilities. In most cases, this court appearance is the only one required, and you will not even see the judge assigned to your case. In addition, your Phoenix bankruptcy lawyer, will attend your 341 Hearing with you to protect your interests. Our Phoenix bankruptcy lawyers will be there for you every step of the way throughout your bankruptcy filing.

Question: Can I stop creditors from bothering me if I file bankruptcy?

FAQ Answer:

Address:

230 N. First Ave, Suite 101

Phoenix, AZ 85003

Phone:

General:

602-682-4000 or 800-556-9230

Click for more information about Phoenix Bankruptcy Court.

At your Phoenix 341 Hearing, the Arizona bankruptcy trustee will ask you questions about your petition, assets, and liabilities. In most cases, this court appearance is the only one required, and you will not even see the judge assigned to your case. In addition, your Phoenix bankruptcy lawyer, will attend your 341 Hearing with you to protect your interests. Our Phoenix bankruptcy lawyers will be there for you every step of the way throughout your bankruptcy filing.

Question: Will I be able to get a credit card after declaring bankruptcy in Phoenix?

FAQ Answer:

Address:

230 N. First Ave, Suite 101

Phoenix, AZ 85003

Phone:

General:

602-682-4000 or 800-556-9230

Click for more information about Phoenix Bankruptcy Court.

At your Phoenix 341 Hearing, the Arizona bankruptcy trustee will ask you questions about your petition, assets, and liabilities. In most cases, this court appearance is the only one required, and you will not even see the judge assigned to your case. In addition, your Phoenix bankruptcy lawyer, will attend your 341 Hearing with you to protect your interests. Our Phoenix bankruptcy lawyers will be there for you every step of the way throughout your bankruptcy filing.

Question: Can my car be repossessed if I am behind on payments?

FAQ Answer:

Address:

230 N. First Ave, Suite 101

Phoenix, AZ 85003

Phone:

General:

602-682-4000 or 800-556-9230

Click for more information about Phoenix Bankruptcy Court.

At your Phoenix 341 Hearing, the Arizona bankruptcy trustee will ask you questions about your petition, assets, and liabilities. In most cases, this court appearance is the only one required, and you will not even see the judge assigned to your case. In addition, your Phoenix bankruptcy lawyer, will attend your 341 Hearing with you to protect your interests. Our Phoenix bankruptcy lawyers will be there for you every step of the way throughout your bankruptcy filing.

Question: Are Pay day loans dischargeable in a Chapter 7 bankruptcy filing?

FAQ Answer:

Address:

230 N. First Ave, Suite 101

Phoenix, AZ 85003

Phone:

General:

602-682-4000 or 800-556-9230

Click for more information about Phoenix Bankruptcy Court.

At your Phoenix 341 Hearing, the Arizona bankruptcy trustee will ask you questions about your petition, assets, and liabilities. In most cases, this court appearance is the only one required, and you will not even see the judge assigned to your case. In addition, your Phoenix bankruptcy lawyer, will attend your 341 Hearing with you to protect your interests. Our Phoenix bankruptcy lawyers will be there for you every step of the way throughout your bankruptcy filing.

Question: How much of my paycheck can be garnished?

FAQ Answer:

Address:

230 N. First Ave, Suite 101

Phoenix, AZ 85003

Phone:

General:

602-682-4000 or 800-556-9230

Click for more information about Phoenix Bankruptcy Court.

At your Phoenix 341 Hearing, the Arizona bankruptcy trustee will ask you questions about your petition, assets, and liabilities. In most cases, this court appearance is the only one required, and you will not even see the judge assigned to your case. In addition, your Phoenix bankruptcy lawyer, will attend your 341 Hearing with you to protect your interests. Our Phoenix bankruptcy lawyers will be there for you every step of the way throughout your bankruptcy filing.

Question: How much notice do I have to be given before my house can be foreclosed on in Arizona?

FAQ Answer:

Address:

230 N. First Ave, Suite 101

Phoenix, AZ 85003

Phone:

General:

602-682-4000 or 800-556-9230

Click for more information about Phoenix Bankruptcy Court.

At your Phoenix 341 Hearing, the Arizona bankruptcy trustee will ask you questions about your petition, assets, and liabilities. In most cases, this court appearance is the only one required, and you will not even see the judge assigned to your case. In addition, your Phoenix bankruptcy lawyer, will attend your 341 Hearing with you to protect your interests. Our Phoenix bankruptcy lawyers will be there for you every step of the way throughout your bankruptcy filing.

Question: Can I get my car back after it has been repossessed?

FAQ Answer:

Address:

230 N. First Ave, Suite 101

Phoenix, AZ 85003

Phone:

General:

602-682-4000 or 800-556-9230

Click for more information about Phoenix Bankruptcy Court.

At your Phoenix 341 Hearing, the Arizona bankruptcy trustee will ask you questions about your petition, assets, and liabilities. In most cases, this court appearance is the only one required, and you will not even see the judge assigned to your case. In addition, your Phoenix bankruptcy lawyer, will attend your 341 Hearing with you to protect your interests. Our Phoenix bankruptcy lawyers will be there for you every step of the way throughout your bankruptcy filing.

Our Phoenix Bankruptcy Attorneys and Bankruptcy Lawyers in Phoenix will answer all of your questions regarding bankruptcy, debt relief, and discharge of your debts! Get your FAQ answers here.

File Now … Pay Later!

Phoenix bankruptcy attorneys serving Chapter 7 and Chapter 13 clients in Phoenix and surrounding communities!

Zip Code Areas in Phoenix That We serve:

- 85001

- 85002

- 85003

- 85004

- 85005

- 85006

- 85007

- 85008

- 85009

- 85010

- 85011

- 85012

- 85013

- 85014

- 85015

- 85016

- 85017

- 85018

- 85019

- 85020

- 85021

- 85022

- 85023

- 85024

- 85025

- 85026

- 85027

- 85028

- 85029

- 85030

- 85031

- 85032

- 85033

- 85034

- 85035

- 85036

- 85037

- 85038

- 85039

- 85040

- 85041

- 85042

- 85043

- 85044

- 85045

- 85046

- 85048

- 85050

- 85051

- 85053

- 85054

- 85055

- 85060

- 85061

- 85062

- 85063

- 85064

- 85065

- 85066

- 85067

- 85068

- 85069

- 85070

- 85071

- 85072

- 85073

- 85074

- 85075

- 85076

- 85077

- 85078

- 85079

- 85080

- 85082

- 85085

- 85086

- 85087

- 85098

- 85099

Neighborhood Areas in Phoenix That We serve:

-

Downtown phoenix

-

Ahwatukee

-

Central Phoenix

-

South Phoenix

-

North Phoenix

-

Desert Ridge

-

Camelback East

-

Deer Valley

-

Biltmore

-

North Mountain

-

South Mountain

-

Norterra

-

Maryvale Village

-

Estrella Village

-

Encanto Village

-

Paradise Valley Village

And the surrounding areas of the Phoenix Metro

DISCLAIMER: The information you obtain at this Arizona Bankruptcy Law web site and on this FAQ page is not, nor is it intended to be, legal advice. You should consult a Phoenix lawyer for advice regarding your individual situation. Also, our Arizona Bankruptcy lawyers and staff invite you to contact our Arizona Bankruptcy Law Firm and welcome your calls, letters, and electronic mail. Contacting us does not create an attorney-client relationship. Please do not send any confidential information to us until such time as an attorney-client relationship has been established. Thank you for visiting our Phoenix debt relief web site.

Serving clients throughout Arizona, including the communities of: Anthem, Apache Junction, Avondale, Buckeye, Casa Grande, Cave Creek, Chandler, Dateland, Fennemore, Flagstaff, Fountain Hills, Gila Bend, Gilbert, Glendale, Holbrook, Kingman, Lake Havasu City, Marana, Mesa, Nogales, Peoria, Phoenix, Phoenix Metro, Queen Creek, Sacaton, Santan, Scottsdale, Sedona, Seligman, South Santan, Sun City, Sun City West, Sun Lakes, Surprise, Sweetwater, Tempe, Waddell, Williams, Winslow, Youngtown, plus, areas in the vicinity of Luke Air Force Base, Phoenix Sky Harbor International Airport, Mesa Gateway Airport, and other communities in Maricopa County.