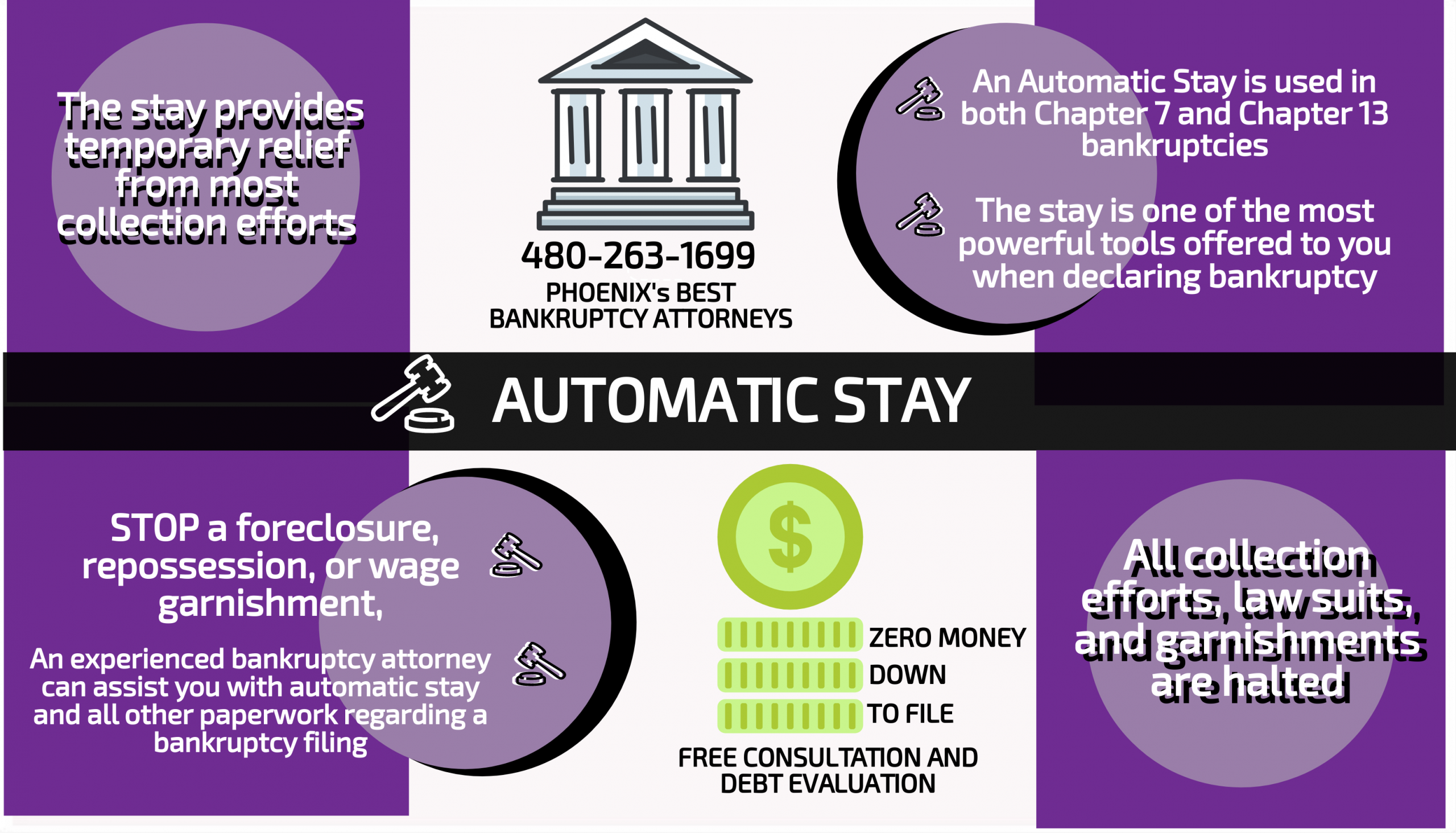

Will Bankruptcy Really Stop Creditor Calls and Harassment?

Yes! Bankruptcy ends creditor harassment. You get the “automatic stay” the moment the bankruptcy is filed. You do not have to go to court to ask for it. Creditors are required to respect it. The automatic stay stops the phone calls, the letters, and ends the feeling of constant harassment. In fact, the automatic stay puts you in control

What The Automatic Stay Covers

- Your creditors must immediately stop contacting you. It takes them a few days to get the notice of bankruptcy filing, but you can give them your case number.

- The automatic stay stops garnishments immediately.

- Also, the automatic stay stops debt collection lawsuits.

- The automatic stay stops repossession and foreclosure.

- Plus, the automatic stay stops eviction.

- The automatic stay prevents your utilities from being shutoff.

- If you lost your drivers license because you were an uninsured motorist or an under insured motorist, you get your license back immediately.

- The collection of an overpayment on public benefits such as social security, worker’s comp, or unemployment; however, this does not apply to a recoupment or later eligibility determination. Recoupment is a complicated area of bankruptcy law that your lawyer can explain to you in more detail.

What The Automatic Stay Does Not Cover

Only a very limited number of debts are not covered by the automatic stay; and, this does not come up often in my cases. If you think that you have a debt that is not covered by the automatic stay, then you should talk to a Seattle – Kent bankruptcy lawyer and I can evaluate your case and explain your options to you.

- The automatic stay does not stop criminal proceedings.

- The automatic stay does not stop actions to enforce or collect on child support, spousal maintenance, or alimony obligations.

- Certain tax proceedings, such as audits and the filing of substitute returns, are not covered by the automatic stay.

- 401(k) loans and other retirement plan loans are not covered by the automatic stay.

- The automatic stay does not prevent non-dischargeability or other adversary proceedings.

- If you have filed bankruptcy in the last year, the automatic stay may be limited to 30 days or not apply at all. You can have the automatic stay extended or reimposed by filing a motion with the court.

How Phoenix Bankruptcy Attorney Stops Creditor Harassment.

Creditor Harassment Protections after Bankruptcy

AREAS OF PRACTICE AND EXPERTISE

Take a Look at How Our Firm Can Help You

Bankruptcy Lawyers in Phoenix, Arizona

Being in debt causes anxiety. Phoenix Bankruptcy Attorneys are to help ease the anxiety. It does not matter if you are facing a foreclosure, a repossession, or have incurred insurmountable credit card debt, give Phoenix Bankruptcy Attorneys a call at (480) 263-1699.

Are you struggling to make ends meet? Do creditors harass you over the phone and through the mail? Does your financial future seem hopeless? If so, there is a solution to your problems! A Phoenix Bankruptcy Lawyer offers free consultations and debt evaluations. Find out what types of debt relief are available and which form of debt relief may be the most beneficial for your particular situation. This affordable bankruptcy attorney in Phoenix can help you achieve the financial freedom you seek. Become debt free!

In today’s difficult times, many people are finding it very difficult to keep up with their financial obligations. In fact, more and more people throughout Arizona are losing their jobs or getting their hours and paychecks reduced, resulting in an unexpected loss of income. Creditors’ Lawsuits, car repossessions, wage garnishments, and constant collection attempts are just a few problems plaguing individuals, families, and businesses in Phoenix and surrounding communities. Additionally, many homeowners are in foreclosure after experiencing a job loss, decrease in pay, and/or an increase in their monthly mortgage payments. No matter what type of financial problems you are facing, a debt relief expert can help you figure out the best solution to your problem and will work to give you the “Fresh Start” that you deserve. Call (480) 263-1699 for a free consultation (Either in one of our Phoenix area offices or by phone, Your Choice!)

Free Consultation with a Bankruptcy Lawyer in Phoenix

Lastly, we offer free bankruptcy consultations in one of our Phoenix area offices and initial evaluations by telephone with one of our experienced attorneys. By all means, call us today and set up your free consultation. For example, maybe you are facing a foreclosure, a repossession, or have incurred insurmountable credit card debt. Our attorneys can go over these issues with you locally here in Phoenix and let you know whether bankruptcy is a good option for you. Remember, bankruptcy is only one option, and an experienced bankruptcy lawyer can develop comprehensive and creative solutions to your debt problems. Furthermore, bankruptcy is our business, let our years of experience and know-how work for you to get you the debt relief that you are seeking.

Our 3-Step process

PHOENIX BANKRUPTCY ATTORNEYS CAN HELP YOU GET OUT OF DEBT

File Now … Pay Later!

Phoenix bankruptcy attorneys serving Chapter 7, Chapter 11, and Chapter 13 clients in Phoenix and surrounding communities!