Chapter 13 Bankruptcy in Phoenix

Phoenix Bankruptcy Chapter 13 Attorney

Filing Chapter 13 BK in Maricopa County

PHOENIX CHAPTER 13 BK FREQUENTLY ASKED QUESTIONS

Our Phoenix Chapter 13 Bankruptcy Attorneys answer many of the most asked questions that people in Maricopa County have about declaring chapter 13 bankruptcy. In the Phoenix Metro Area there are many people who run against hard times and need a “Fresh Start” to get back on track financially. The lawyers in our Phoenix based bankruptcy firm assist hundreds of people yearly with debt relief actions including filing Chapter 13 bankruptcy. Contact our office today for a consultation. (480) 262-1699. Both the consultation and the advice are free of charge. Also, please know that our consultations are 100% confidential.

PHOENIX CHAPTER 13 LAWYER

How a Chapter 13 bankruptcy can benefit your financial debt situation:

Every Chapter 13 Bankruptcy case in Phoenix is unique in itself. There are many factors and variations to a Ch 13 BK. Thus, having an experienced Phoenix Chapter 13 Bankruptcy Lawyer will benefit you as they can assist with making sure that you are filing the proper Chapter of Bankruptcy for the filers financial debt situation.

Often, the reason why many people in Phoenix decide to file a Chapter 13 vs. a Chapter 7 bankruptcy is because it allows individuals to keep all their property, including non-exempt assets.

However, in order to qualify for Chapter 13 bankruptcy, you must demonstrate that you have a steady income in order to pay back a portion of your debts as agreed upon in a repayment plan. (Usually 3-5 years). Because of this Ch 13 Repayment plan, the bankruptcy can become very complex.

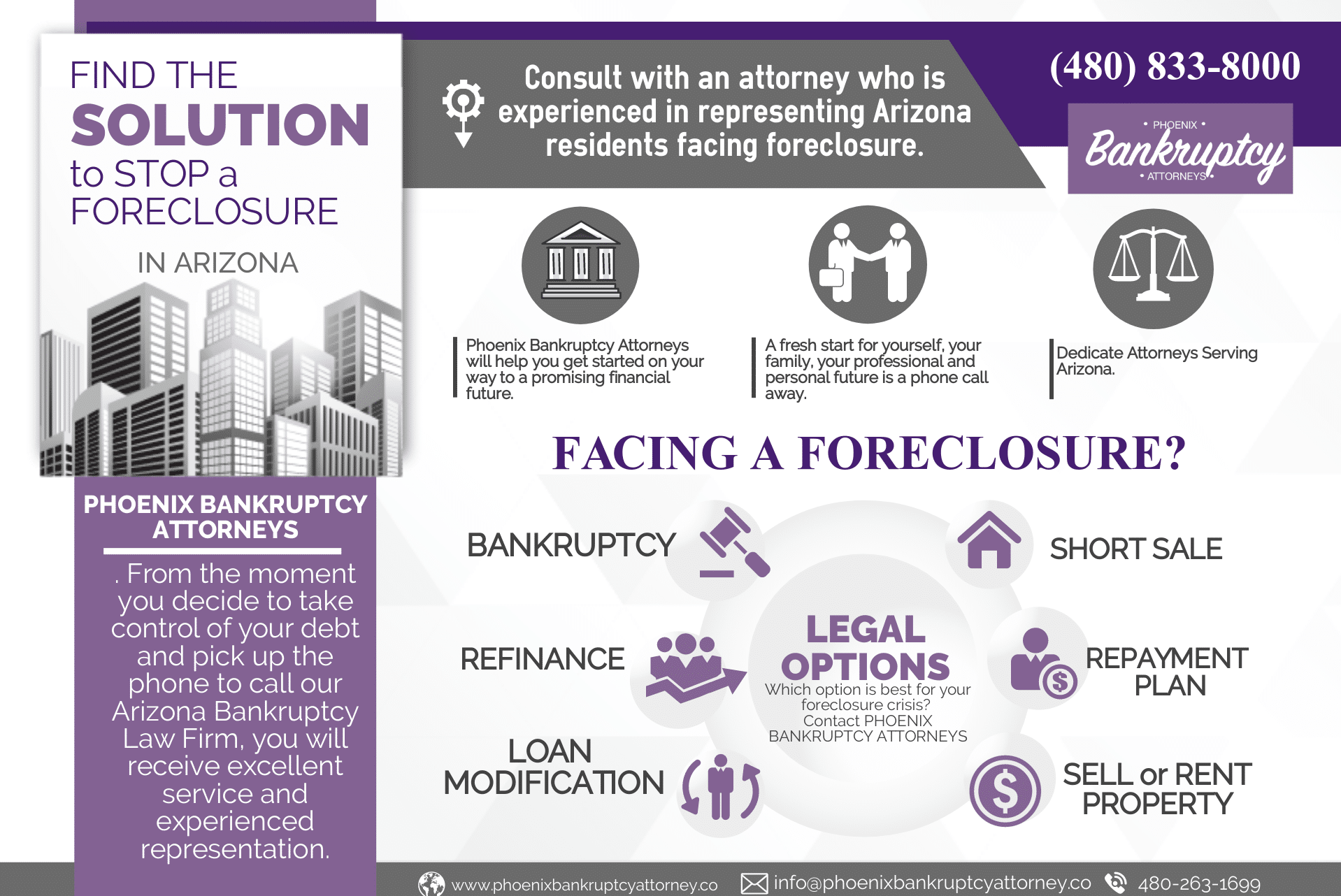

Declaring Chapter 13 bankruptcy in Phoenix, Arizona can help put an end to your downward financial spiral by:

- Stopping lawsuits and garnishments filed by creditors.

- Chapter 13 buys you more time to service your debts.

- Filing will stop collection actions on your Student Loans.

- Preventing foreclosure on your unsold home.

- Returning your repossessed vehicle to you.

- Ch 13 allows you to keep your car.

- Ch 13 in Phoenix allows you to keep your home.

- Resolving tax problems and back taxes.

Contact Us

File Now … Pay Later!

Phoenix bankruptcy attorneys serving Chapter 7 and Chapter 13 clients in Phoenix and surrounding communities!