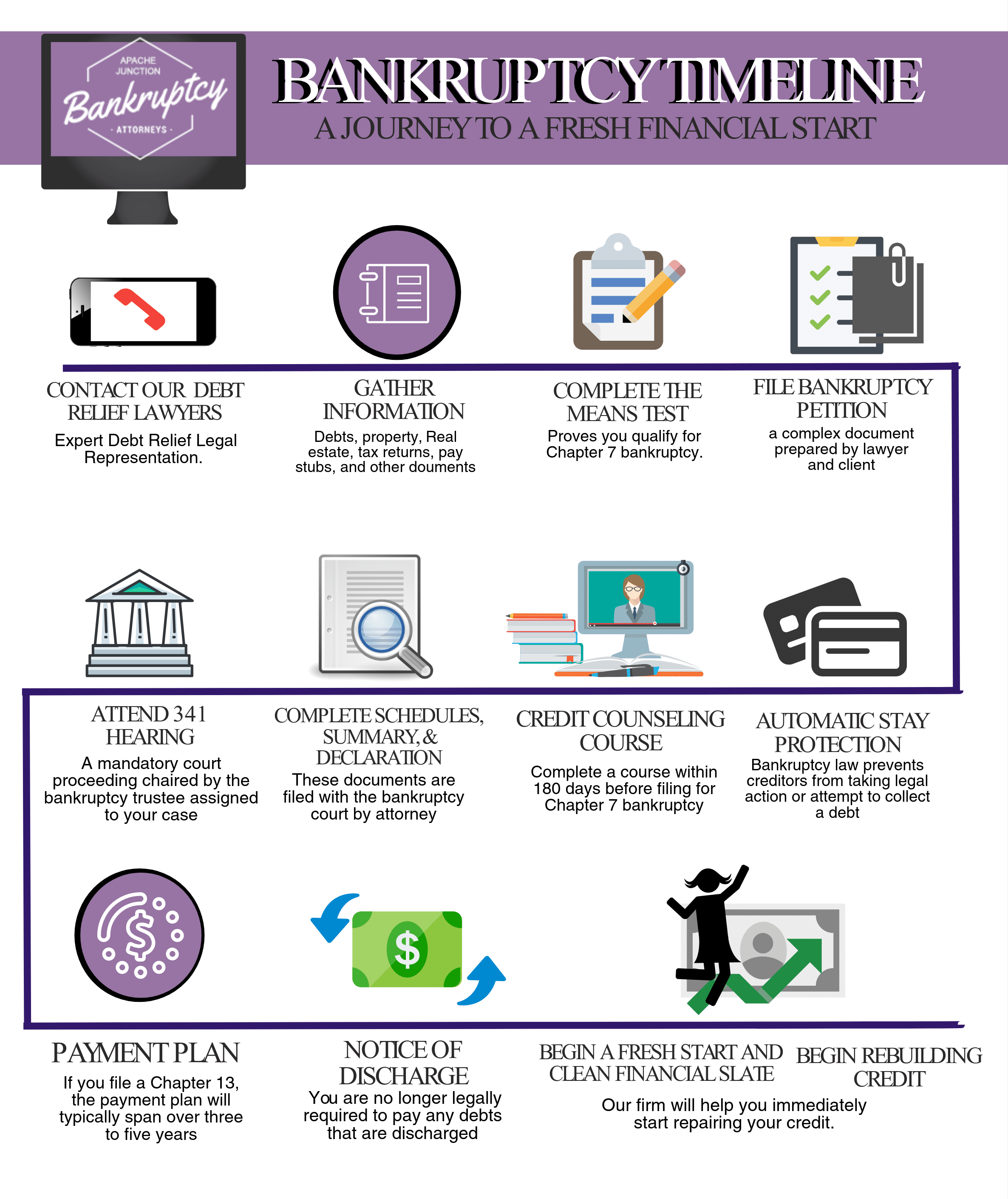

1. Contact an experienced bankruptcy attorney- If you have an attorney retained for any other matter, they most likely can refer you to a competent bankruptcy attorney. If you don’t have an attorney for another matter and don’t have bankruptcy attorney referrals from friends or family, you can search online. The State Bar also has attorney referrals.

Once you find the names and contact information for bankruptcy attorneys in your area, you should contact them to schedule a consultation. Some attorneys charge for consultations, so either confirm that they are free or make sure you can afford their fee. If your schedule isn’t flexible, some attorneys may be able to offer telephonic or after-hours consultations.

2. Gather information- In your consultation, your attorney should review the details of your case to see which documents you will need to provide for your bankruptcy petition. Examples of documents almost everyone needs to submit are bank statements, 6 months of paystubs, and your last two tax returns. Check with your attorney to see how you should submit your documents- some may have a secure client portal to upload your documents, while others may prefer email, fax, standard mail, or for you to drop off your documents in person. Do not expect your bankruptcy to be instantly filed once you submit your documents. Your attorney will need to review your documents and draft your petition, which is usually at least 50 pages long.

3. Complete the Means Test- Once you submit your documents to your attorney, they will need to confirm that you are eligible for whichever Chapter of bankruptcy you are filing. If you want to file a Chapter 7 bankruptcy, you must either make below the median income level for your family size in your state, or pass the Means Test. The median income for a single filer with no dependents is $51,388, but this only increases by about $10,000 for each family member you add.

If you make above the median income level for your family size, you must prove you don’t have enough money left at the end of the month to pay your debts through the Means Test. This will involve averaging your income over the last six months and subtracting deductions and expenses deemed reasonable by the bankruptcy court. If you don’t have enough disposable monthly income, you will still be able to file a Chapter 7. If you are above the median income level and can’t pass the Means Test, you still have Chapter 13 bankruptcy as an option.

4. First Credit Counseling Class- You must complete this course before your case is filed. You can take the course up to 180 days before filing your case. Don’t wait until the last second to take your course- depending where your credit counseling agency is located, there may be issues with the time stamp on the course certificate. You will also be required to discuss your situation with a credit counselor, who may not be available at all hours.

5. File your bankruptcy- Once your attorney has drafted your petition and you have completed your credit counseling class, you will meet with your attorney to review the petition. You will check that all the information is correct, all your creditors are included, and sign portions of the petition. Your attorney will then file the petition for you.

6. Automatic Stay Protection- Once your bankruptcy is filed, an automatic stay of protection goes into effect. This prevents your creditors from garnishing your wages, foreclosing on your home, and repossessing your car. The stay remains in effect until your case is discharged or dismissed. Exceptions may apply if you have filed bankruptcy multiple times. If you are filing to stop a wage garnishment, you or your attorney will need to provide your case number to your payroll department.

7. Complete Schedule (Chapter 13), Declaration- You must file your proposed payment plan and schedules within 14 days of filing your bankruptcy petition. If the plan is approved, you will continue submitting payment to the trustee, who will disburse these funds to your creditors.

8. Attend 341 Hearing- You will receive a letter from your bankruptcy trustee 10-15 days after filing your bankruptcy. The trustee will likely request additional documents and you will be assigned a date for your 341 Meeting of Creditors.

Your 341 Meeting of Creditors will be 30-45 days after filing your bankruptcy. Make sure you are on time and bring your driver’s license and social security card. The hearing should be relatively short and your attorney should prepare you for it in your petition signing.

9. Payment Plan (Chapter 13)- Regardless of if your schedules have been approved or not, you will need to begin payments on your payment plan within 30 days of filing your bankruptcy. The length of your payment plan will depend on if you fall above or below the median income level. If you fall below the median income level but are filing a Chapter 13, your payment plan will be 3 years. If you are above the median income level, it will be 5 years. A Chapter 13 bankruptcy can’t legally extend past 5 years.

10. Second Credit Counseling Course- You will have 60 days after your 341 Meeting of Creditors to complete your second credit counseling course. Your attorney will file your course certificate with the court for you.

11. Notice of Discharge- If you have completed all the steps of your Chapter 7 bankruptcy, your case will be eligible for discharge 60 days after your 341 Meeting of Creditors. It may take the court a few more days to officially process your discharge.

If you are in a Chapter 13 Bankruptcy, your case won’t be eligible for discharge until you complete your payment plan. Review Step 9 for information on how long your payment plan will be.

12. Fresh Start! Begin Rebuilding Credit- Once you have discharged your debts in bankruptcy, you may find it easier to open new lines of credit and finance a vehicle. These are great ways to rebuild your credit. Your lender won’t be required to report positive payments if you keep the same car throughout your bankruptcy.

If your attorney offers a $0 down payment plan option, check to see if they credit report payments to help boost your credit after filing. If you are unable to get a new credit card, you can open a secure line of credit through your bank. The bankruptcy will remain on your credit report for 10 years for a Chapter 7, and 7 years for a Chapter 13.

Contact Us

File Now … Pay Later!

Phoenix bankruptcy attorneys serving Chapter 7 and Chapter 13 clients in Phoenix and surrounding communities!