Wage Garnishment Attorneys in Phoenix

Phoenix Wage Garnishment Lawyers

PHOENIX BANKRUPTCY LAWYERS CAN HELP

Call Phoenix bankruptcy attorneys right away. We can stop your wage garnishment immediately and get you on the right path to a fresh start. Our Phoenix wage garnishment attorneys can file an emergency bankruptcy filing in order to stop your creditors from taking your hard earned money.

One of the many ways that creditors will attempt to collect on a debt from you may be the threat of wage garnishment. It is important to take action to stop the wage garnishment before it starts. If you have received a notification that your wages may be garnished, seek out our experienced attorneys immediately. Find out what options are available to you in stopping a wage garnishment in Phoenix. and we will also help you understand how filing for bankruptcy can stop the garnishment of your wages. Don’t delay! Stop wage garnishments before they get started.

Get Details on our “File Bankruptcy Now, Pay for Bankruptcy Later” Plan.

WAGE GARNISHMENT BASICS

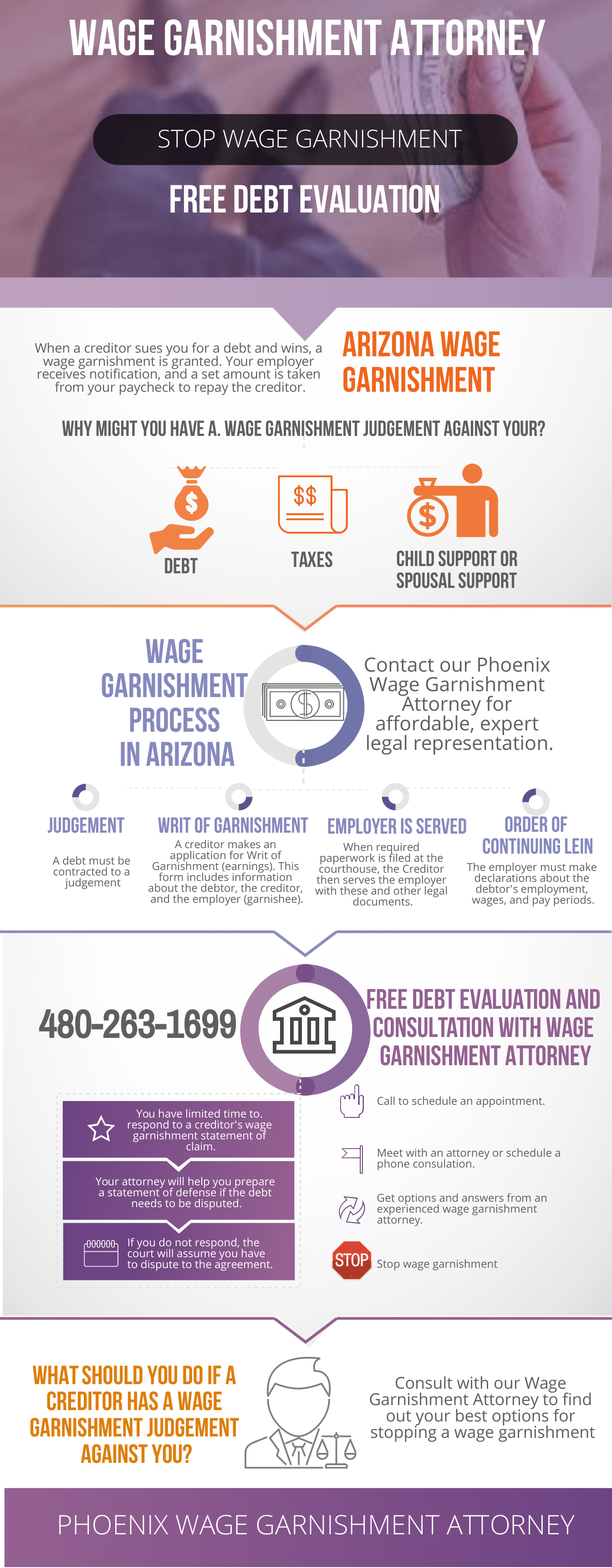

When the court orders a wage garnishment, the order is sent to your employer. The order requires the employer to withhold a determined amount of money from your paycheck. This money is then sent directly to the creditor to whom you owe a debt. There are legal limits to how much can be taken from your paycheck. These limits depend on the debt, but basically you should have enough left in your check to cover living expenses. Arizona limits for wage garnishments are governed by federal law.

Our wage garnishment attorneys are experts in Arizona garnishment, and can help you understand the rules dictated by the law. Creditors can only take either 25% of non-exempt weekly earnings, or the amount of these earnings that exceeds 30 times federal minimum wage, whichever is less. Some debts owed like student loans, taxes, or child support can be garnished without a judgement from the court. The amount of wages taken from a check can also differ with these types of debt.

When there is a judgment against you by a creditor, you are at risk for wage garnishment. If there is a judgment for wage garnishment. That means that one of your creditors has sued for not paying a debt, and was granted a judgment to collect the money. Your employer is notified of the judgement, and holds back a set amount of money from your wages to pay the creditor.

WHY YOU NEED EXPERT LEGAL REPRESENTATION

Why do you need the expert legal representation of our Phoenix wage garnishment attorney? An attorney knows how to stop a garnishment. For an employer, complying with the orders per wage garnishment can be a hassle. Instead of accommodating the order, they may choose termination. You have rights, and our law firm knows the law that provides protection in this kind of situation.

You may not be able to afford wages being taken from your paycheck. Consult with our Phoenix wage garnishment attorney and schedule a free consultation to get answers about a wage garnishment judgement against you.

File Now … Pay Later!

Phoenix bankruptcy attorneys serving Chapter 7 and Chapter 13 clients in Phoenix and surrounding communities!

Zip Code Areas in Phoenix That We serve:

- 85001

- 85002

- 85003

- 85004

- 85005

- 85006

- 85007

- 85008

- 85009

- 85010

- 85011

- 85012

- 85013

- 85014

- 85015

- 85016

- 85017

- 85018

- 85019

- 85020

- 85021

- 85022

- 85023

- 85024

- 85025

- 85026

- 85027

- 85028

- 85029

- 85030

- 85031

- 85032

- 85033

- 85034

- 85035

- 85036

- 85037

- 85038

- 85039

- 85040

- 85041

- 85042

- 85043

- 85044

- 85045

- 85046

- 85048

- 85050

- 85051

- 85053

- 85054

- 85055

- 85060

- 85061

- 85062

- 85063

- 85064

- 85065

- 85066

- 85067

- 85068

- 85069

- 85070

- 85071

- 85072

- 85073

- 85074

- 85075

- 85076

- 85077

- 85078

- 85079

- 85080

- 85082

- 85085

- 85086

- 85087

- 85098

- 85099

Neighborhood Areas in Phoenix That We serve:

-

Downtown phoenix

-

Ahwatukee

-

Central Phoenix

-

South Phoenix

-

North Phoenix

-

Desert Ridge

-

Camelback East

-

Deer Valley

-

Biltmore

-

North Mountain

-

South Mountain

-

Norterra

-

Maryvale Village

-

Estrella Village

-

Encanto Village

-

Paradise Valley Village

And the surrounding areas of the Phoenix Metro

Please consult a bankruptcy attorney in Phoenix for advice about your individual situation. This site and its information is not legal advice, nor is it intended to be. Please contact us via email, phone calls, or letters and we will gladly speak with you. In doing so, this does not create an attorney-client relationship. Until we have established an attorney-client relationship, please do not send any confidential information to us. Our Phoenix Bankruptcy Lawyer and staff look forward to assisting you.

We also serve the Cities in Arizona including: Tucson, Mesa, Gilbert, Avondale, Chandler, Ahwatukee, Queen Creek, Scottsdale, Peoria, and Glendale.